State of the Union

November 2025

Why I’m Sharing This

Each month, I will be posting my real numbers — income, expenses, debts, and cash flow — for two primary reasons:

1. Transparency:

I want this blog to show real numbers and the actual journey from financial ruin → to being debt-free → to financial freedom.

2. Accountability:

Writing these posts keeps me honest, focused, and faith-driven.

If these posts help even one person feel less alone in their financial journey, it’s worth it.

Income Breakdown

(All numbers post-tax unless noted.)

W2 Income: $8.491

Side Hustles: $0

Other: $0

➡️ Total Monthly Income: $8,491

This month, I took a week off to join my family for Thanksgiving, so I took a big hit on the income front. Also, I didn’t receive rent from my tenant this month because it was paid in October.

Expense Breakdown

Major Categories

Mortgage: $4,529

Rent: $606

Utilities: $366

Groceries: $257

Insurance: $0

Telephone: $38

Tithing: $0

Loans: $3,271

Personal Debts: $1,000

Daily Living

Restaurants: $244

Entertainment: $50

Personal Care: $0

General Merchandise: $80

Online Services: $129

Cable/Satellite: $0

Other Expenses

Automotive: $337

Travel: $251

Electronics: $0

Postage/Shipping: $0

Office Supplies: $0

Healthcare/Medical: $67

Service Charges/Fees: $1,032

Education: $1,929

Other Bills: $10

➡️ Total Monthly Expenses: $14,197

Okay, let’s talk about this. Firstly, let’s talk about a win. My grocery category was much smaller… that’s because I visited family and with Thanksgiving happening, food (and leftovers) were provided!

Now for a negative: my credit cards and debt are eating me alive. The $3,271 and $1,032 loans and service charges/fees categories are almost all credit card related (save for some on my car’s behalf and student loans). I need to get these knocked out. Once I sell my house, that will free up about $5,000 per month as well as hopefully make me a little money that I can tackle a credit card or two with!

Sadly again, I chose not to tithe this month out of fear of adding to my credit card balances. This is hard for me.

Cash Flow Summary

Income: $8,491

Expenses: $14,197

➡️ Pure Cash Flow: - $5,706

➡️ Savings Rate: 0%

I knew this was coming. Considering I took a week off of work (which already decreases my income by almost $3,000) and traveled, I can’t say I’m surprised. This is a kick in the pants, though. I had to dip into my (tiny) reserves for this month so as not to incur more debt. Sadly, I’ll be traveling for one week in December too, for Christmas. Maybe I should travel home less often, but I have to say seeing my family is incredibly worth it.

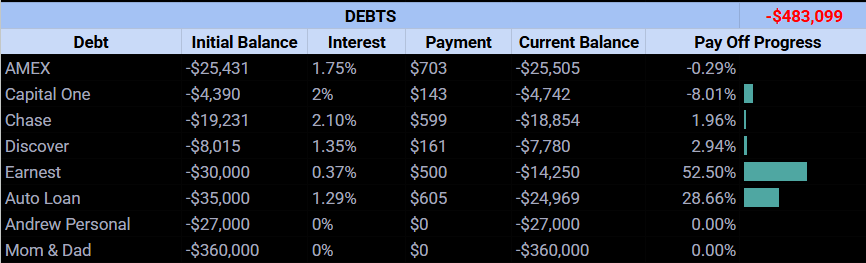

Debt Snapshot

Here’s where everything stands this month, straight from my Google Sheet:

There hasn’t been much change here, just small fluctuations with the credit card balances; I am liking what' I’m seeing with the Earnest student loan and the auto loan. Those sparklines are music to my ears.

Things I’ll Sustain from This Month

Didn’t really add to credit card debt

Kept grocery bill low

Got to spend time with family

Things I’ll Improve Next Month

Keep restaurants under $100

Sell my house (please, Lord)

Tithe first

Closing Thoughts

Everything is a work in progress. I didn’t sell my house, didn’t tithe first, and didn’t keep restaurant spending below $100. I did, however, get multiple showings, prayed more and kept tithing more top-of-mind, and lowered my restaurant spending.

I just have to take it one day at a time. Until next time.