State of the Union: December 2025

Why I’m Sharing This

Each month, I will be posting my real numbers — income, expenses, debts, and cash flow — for two primary reasons:

1. Transparency:

I want this blog to show real numbers and the actual journey from financial ruin → to being debt-free → to financial freedom.2. Accountability:

Writing these posts keeps me honest, focused, and faith-driven.If these posts help even one person feel less alone in their financial journey, it’s worth it.

Income Breakdown

(All numbers post-tax unless noted.)

W2 Income: $8,838

Side Hustles: $2,878

Other: $0➡️ Total Monthly Income: $11,716

This month, I did take another week off to join my family for the week before Christmas, so I took a hit on the W2 income front, but I did choose to sell a lot of my belongings that weren’t doing me any good — like my old, barely used pressure washer from a now abandoned business idea; that made me a good amount of money! Pro-tip: Annual garage audits. Clean out your garage and make some money at the same time. Maybe this could be a new business…

Also, some of the “Side Hustle” income (about $200) was actually a refund from my least favorite airline, Frontier. Seriously, 0 for 2, Frontier.

Expense Breakdown

Major Categories

Mortgage: $4,917

Rent: $597

Utilities: $449

Groceries: $325

Insurance: $0

Telephone: $38

Tithing: $0

Loans: $2,954

Personal Debts: $0

Daily Living

Restaurants: $330

Entertainment: $153

Personal Care: $0

General Merchandise: $39

Online Services: $0

Cable/Satellite: $50

Other Expenses

Automotive: $5,846

Travel: $1,004

Electronics: $20

Postage/Shipping: $0

Office Supplies: $0

Healthcare/Medical: $32

Service Charges/Fees: $1,136

Education: $82

Other Bills: $430

➡️ Total Monthly Expenses: $18,402

Sad day. Again, my debt, credit cards, and charges on interest for said debt and cards are destroying me. Not to mention, I’ve still not sold my house, so that’s really taking a toll, at about $5,000. I cannot wait to sell it!

Also, I did a thing. I traded in my Tesla for a car with lower payments. Instead of the ~$700 per month, it’ll be around $600 per month. I did put $5,000 down for the trade-in though, so it certainly cost me. In the future with the lower payments, I think I’ll get by a little easier though. And, not to mention, the main reason for the trade-in was safety — with me traveling far from home, inclement weather was really starting to put me in tough situations where I would have to call out from work or risk crashing.

Cash Flow Summary

Income: $11,716

Expenses: $18,402➡️ Pure Cash Flow: - $6,686

➡️ Savings Rate: 0%Considering I put $5,000 down for a car, took a week off of work (costing me around $3,000) and traveled (costing me around $1,000), I can’t say I’m surprised about the negative cash flow. Good news is I have the travel AND opportunity cost from travel averaged out over the entire year, so I should fall right at budget. I just have to put my nose to the grindstone and work hard on the home-selling front. I’ve decided that I need to swallow my pride, laziness, or whatever it is that keeps me working tons of hours each week and just take extra shifts when I can. I’ll start with an extra 8 hours each week and see how that affects my income.

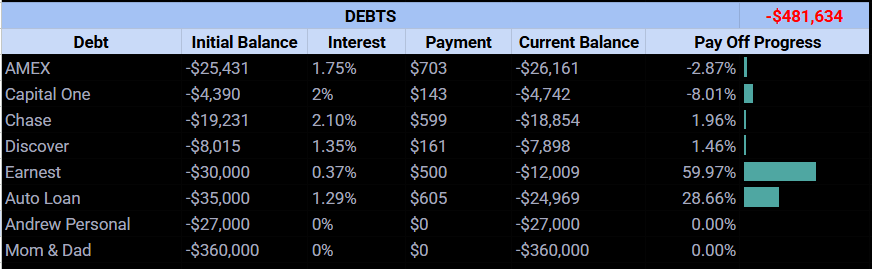

Debt Snapshot

Here’s where everything stands this month, straight from my Google Sheet:

Hey, look at that! My Earnest loan is slowly disappearing! The rest of my numbers aren’t a wonder to look at, they are some ugly numbers!

Things I’ll Sustain from This Month

Kept grocery bill low

Got to spend time with family

Made some extra money by selling old, unwanted items

Things I’ll Improve Next Month

Keep restaurants under $100 for once!

Sell my house (please, Lord)

Tithe first

Closing Thoughts

Everything is a work in progress. I didn’t sell my house, didn’t tithe first, and didn’t keep restaurant spending below $100. I have a lot to work on, from within and without.

I just have to take it one day at a time. Until next time.