State of the Union

October 2025

Why I’m Sharing This

Each month, I will be posting my real numbers — income, expenses, debts, and cash flow — for two primary reasons:

1. Transparency:

I want this blog to show real numbers and the actual journey from financial ruin → to being debt-free → to financial freedom.

2. Accountability:

Writing these posts keeps me honest, focused, and faith-driven.

If these posts help even one person feel less alone in their financial journey, it’s worth it.

Income Breakdown

(All numbers post-tax unless noted.)

W2 Income: $14,015

Side Hustles: $1,800

Other: $0

➡️ Total Monthly Income: $15,815

This month was a five-week month, so income was a bit higher than usual. I also still haven’t sold my house, so one of my tenants paid both October and November’s rent on the 1st and 31st — that’s the $1,800.

Expense Breakdown

Major Categories

Mortgage: $4,529

Rent: $592

Utilities: $533

Groceries: $630

Insurance: $261

Telephone: $27

Tithing: $0

Loans: $1,219

Personal Debts: $3,261

Daily Living

Restaurants: $269

Entertainment: $59

Personal Care: $65

General Merchandise: $40

Online Services: $109

Cable/Satellite: $85

Other Expenses

Automotive: $61

Travel: $463

Electronics: $0

Postage/Shipping: $0

Office Supplies: $0

Healthcare/Medical: $0

Service Charges/Fees: $1,049

Education: $0

Other Bills: $0

➡️ Total Monthly Expenses: $13,252

This is where it hurts: that expense number is scary and embarrassing to share. The good news is that once I sell my house, my mortgage, utilities, and cable disappear completely — a total of $5,147 per month. I’ll end up renting a spare room back home to keep me (and the IRS) happy, but that won’t cost much.

My travel and restaurant spending were high because I flew home to see my family — something I’ll always happily spend on.

Lastly, I wasn’t able to tithe this month out of fear of adding to my credit card balances. That’s something I’m actively working on changing. Tithing should come first. God isn’t getting 10% from me — He’s giving me the gift of keeping 90%.

Cash Flow Summary

Income: $15,815

Expenses: $13,252

➡️ Pure Cash Flow: + $2,563

➡️ Savings Rate: 16.21%

Even though I’m not thrilled with my expenses, there’s a lot to be thankful for. My savings rate was higher than expected. I still managed to bring in cash despite paying $3,261 toward my failed business’ lease and still covering my personal mortgage.

I use sparklines in Google Sheets, and seeing the little green line move to the right feels good. It’s progress, even if slow.

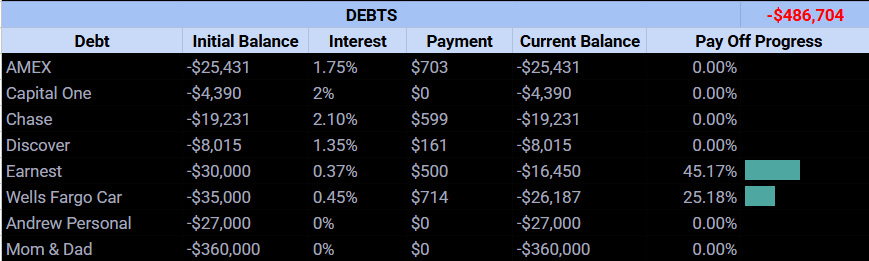

Debt Snapshot

Here’s where everything stands this month, straight from my Google Sheet:

Right now, I’m focusing all net cash flow on making sure I don’t have to borrow more. I also had to catch up on some payments, so my bank account doesn’t look like I had a $2,563 surplus — but time heals all.

Once the house sells, I can save more and will use the extra cash (from not paying the mortgage) to wipe out Chase and Discover during my second (and last) contract of 2025. If I get any cash from the house sale, I’ll put some toward my parents and hopefully pay off my car — which would free up another ~$1,000/month between the car note and related expenses.

Things I’ll Sustain from This Month

Solid savings rate

Didn’t add to credit card debt

Got to spend real time with family

Things I’ll Improve Next Month

Keep restaurants under $100

Sell my house (please, Lord)

Tithe first

Closing Thoughts

This month taught me that stewardship is slow and steady. God has been teaching me discipline — how to treat His money as something entrusted, not owned.

I’m grateful for progress, even the small pieces of it.

These numbers aren’t where I want to be, but I know I’m in this season for a reason.